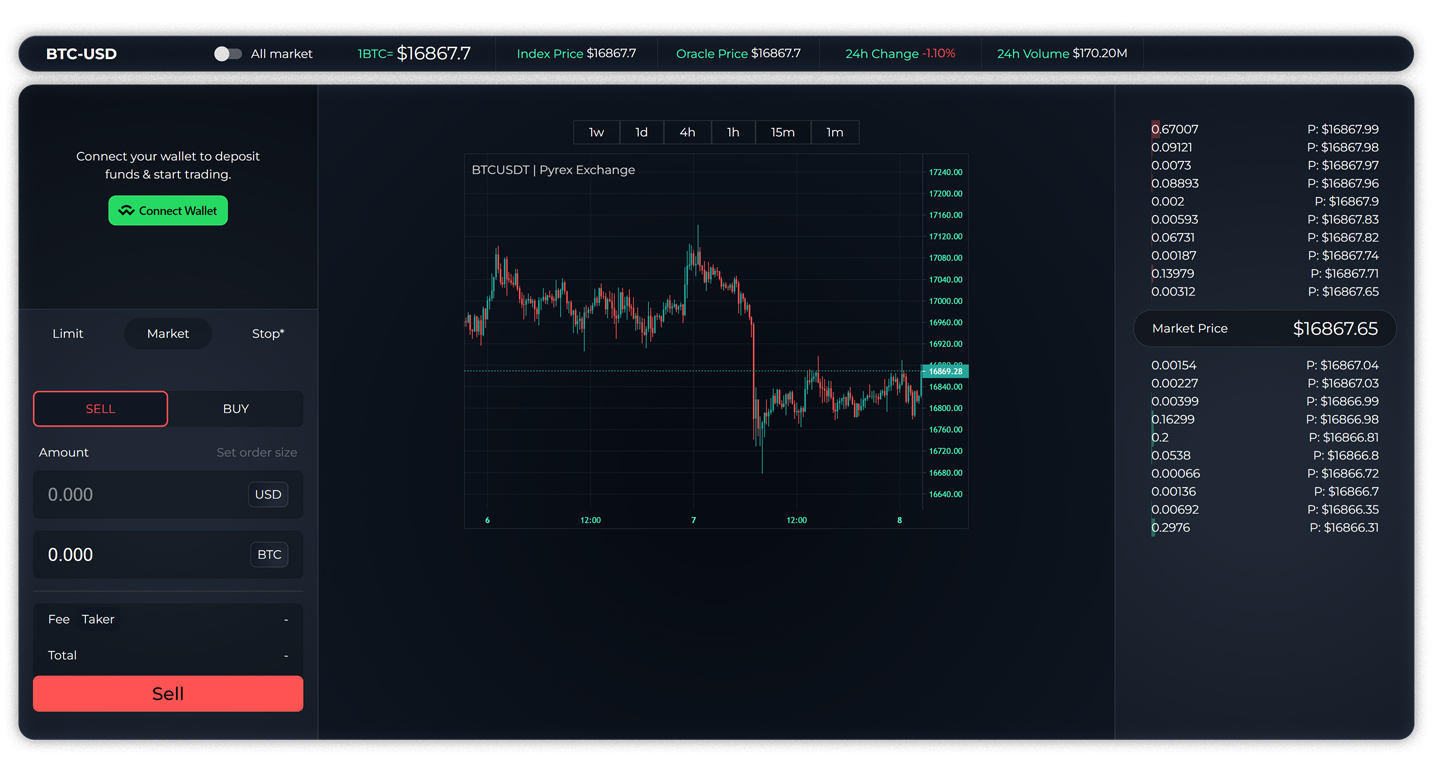

Trade for free*

Trade Perpetual Contracts with no fees*, deep liquidity, and up to 20x more Buying Power. Deposit just $10 to get started.

Contract:0x0000..0000

Now available on mobile!

Available for IOS now. Coming to Android early next year.

NOW LIVE!

START TRADING

We are continuously launching new Perpetual Contract markets.

BTC-USD

$NaN

CHG:

%NaN

VOL:

$NaNM

ETH-USD

$NaN

CHG:

%NaN

VOL:

$NaNM

BNB-USD

$NaN

CHG:

%NaN

VOL:

$NaNM

MATIC-USD

$NaN

CHG:

%NaN

VOL:

$NaNM

SOL-USD

$NaN

CHG:

%NaN

VOL:

$NaNM

AVAX-USD

$NaN

CHG:

%NaN

VOL:

$NaNM

TRX-USD

$NaN

CHG:

%NaN

VOL:

$NaNM

ADA-USD

$NaN

CHG:

%NaN

VOL:

$NaNM

DOGE-USD

$NaN

CHG:

%NaN

VOL:

$NaNM

NEAR-USD

$NaN

CHG:

%NaN

VOL:

$NaNM

SPOT TRADING & DECENTRALIZED PERPETUAL FUTURES

WHY

We combined the best of decentralized and centralized exchanges

| CEX | DEX | ||

|---|---|---|---|

Confidential marketplace | |||

Decentralized custody exchange | |||

Centralized order book | |||

No slippage | |||

Free from MEV | |||

Free from preferential market access |

FAQs

Frequently asked questions

What is DEX?

DEX is short for decentralized exchange. It is a type of cryptocurrency exchange that does not rely on a third party service to hold the customer's funds. Instead, trades occur directly between users (peer-to-peer) through an automated process. This allows for more secure and efficient trading, as it eliminates the need for a trusted third party.

Are DEXs safer than centralized exchanges?

It is generally considered that decentralized exchanges (DEXs) are safer than centralized exchanges (CEXs), for a few reasons. First, DEXs do not hold users' funds directly, so there is no central point of failure that can be exploited by hackers. Instead, trades occur directly between users on the blockchain, which makes it much more difficult for hackers to steal funds. Additionally, DEXs often have more robust security features, such as built-in smart contract auditing and multi-signature technology, which can provide an additional layer of protection for users. Finally, because DEXs are decentralized and do not rely on a single entity to facilitate trades, there is no single point of control. This means that users have more control over their own funds, and are less vulnerable to censorship or interference by external parties. Overall, while DEXs are not immune to security risks, they are generally considered to be safer than CEXs.

What is a Layer 2 trading platform?

A Layer 2 trading platform is a type of platform that is built on top of a blockchain network, such as the Ethereum network. It uses the underlying network to secure transactions and facilitate trade, but adds additional features and functionality to improve scalability and performance.

What are the advantages of using a Layer 2 platform for spot and perpetual trading?

Some of the advantages of using a Layer 2 platform for spot and perpetual trading include improved scalability and performance, as the additional layer of the platform can help to offload some of the workload from the underlying network. This can result in faster transaction times and lower fees, which can make trading more efficient and cost-effective.

How do I access the trading platform?

To access the trading platform, you will need to set up an account and deposit some funds. Once you have done this, you can use the platform's trading interface to buy and sell cryptocurrencies and participate in perpetual trading. The exact process can vary depending on the platform, so it is important to read the platform's documentation or tutorials before getting started.

What is Spot Trading?

Spot trading is a type of trading that involves the immediate purchase and sale of a financial instrument, such as a cryptocurrency, at the current market price. This is in contrast to other types of trading, such as futures or options trading, where the transaction is completed at a future date or at a price that is agreed upon in advance. In the context of cryptocurrency, spot trading typically refers to the buying and selling of digital assets on a cryptocurrency exchange, using either fiat currency (e.g. US dollars) or another cryptocurrency as the medium of exchange. Spot trading allows investors to take advantage of price movements in the market and make profits from buying low and selling high. It is one of the most common forms of trading in the crypto market, and is often used by both retail and institutional investors.

What is Perpetual Trading?

Perpetual trading, also known as perpetual swaps or perpetual contracts, is a type of derivative financial product that allows traders to speculate on the price of an underlying asset without an expiry date. These contracts have features that are similar to futures contracts, but they do not have a fixed expiry date or settlement date. Instead, they are designed to be held indefinitely, with the investor making periodic payments to maintain their position. This allows traders to take advantage of price movements on a continuous basis, rather than being limited to the expiry of a traditional futures contract. Perpetual trading is commonly used in the cryptocurrency market, where it is often offered by decentralized exchanges (DEXs) as a way for traders to speculate on the price of various digital assets.

What is Price Impact?

Market price impact refers to the effect that a trade has on the market price of an asset. In a decentralized exchange (DEX), market price impact can occur when a large trade is executed on the DEX, causing the price of the asset to move in response to the increased demand or supply. This can have a number of consequences, such as affecting the profitability of other traders on the DEX, or causing liquidity problems if the trade is large enough to significantly affect the supply and demand balance in the market. Market price impact is an important consideration for traders on DEXs, as it can have a significant effect on their ability to make profitable trades. In general, market price impact is a natural byproduct of trading, and is a common feature of both centralized and decentralized exchanges. However, the lack of central control on DEXs can sometimes make market price impact more pronounced, and it is important for traders to be aware of this when making trading decisions.

Can I trade any cryptocurrency on Pyrex Exchange?

Pyrex supports a wide range of cryptocurrencies, but the exact selection of assets available can vary depending on the Pyrex. It is important to check the Pyrex's supported assets before using it to trade.

How do I start trading on Pyrex Exchange?

To start trading on a DEX, you will need to set up a wallet and deposit some funds into it. Then, you can use the DEX's trading interface to buy and sell cryptocurrencies. The exact process can vary depending on the DEX, so it is important to read the DEX's documentation or tutorials before getting started.

Is the platform secure?

The trading platform uses the underlying Binane Smart Chain network to secure transactions and protect user funds. Additionally, the platform has its own security measures in place, such as multi-signature technology and smart contract auditing, to help ensure the safety and security of users' funds. However, as with any platform, it is important for users to take steps to protect their own accounts, such as using strong passwords and enabling two-factor authentication.

Revolutionize your trading with Pyrex's low-cost, high-speed decentralized exchange

About

Terms of Use

Rules for using the platform

Privacy Policy

Our policies around data

Legal

Our legal docs and terms

Help Center

Tips & tricks for using Pyrex Exchange

Copyright © 2022 Pyrex Exchange Inc. - All rights reserved.